Yesterday, the March 2021 Revenue Forecast was presented to the legislature. This is the fourth forecast capturing the impact of COVID-19 on Oregon’s economy and the first of 2021. Even with some business sectors restricted by Oregon’s COVID-19 rules, Oregon’s tax revenue is holding steady.

General Fund and other major revenues are now slightly up from pre-COVID-19 levels. An ending balance of $1,232.5 million above the 2019 close-of-session estimation is projected.

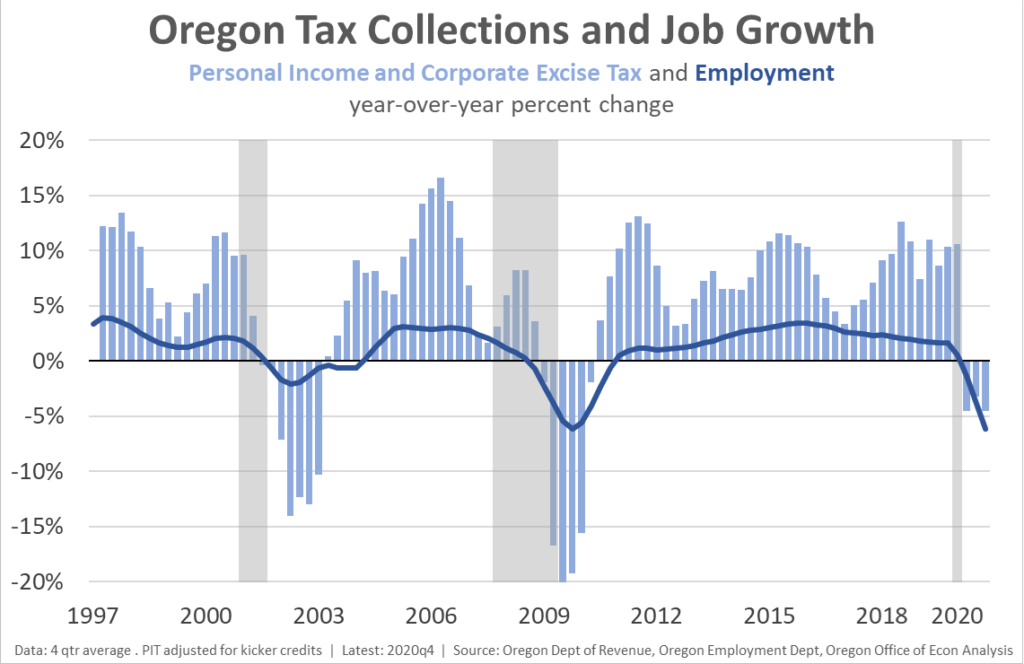

To date, the revenue losses in the current recession pale in comparison to Oregon’s recent experiences. Job losses over the past year match the worst of the Great Recession, however revenue declines are much less severe. This is contributed to federal aid packages, stronger personal savings heading into the recession and steady business income.

One surprise from the forecast was that healthy revenue collections are putting Oregon’s kicker into play. Following a booming first half of the biennium, Oregon’s General Fund revenue outlook was very close to the kicker threshold when the pandemic hit. After filling all of the recessionary hole, the March 2021 forecast calls for collections to exceed the threshold by $170 million (0.9%), resulting in a kicker credit of $571 million. However, this kicker credit is far from a sure thing. Oregon has the uncertainty of one more tax season left in the biennium.

Lottery revenues have been the hardest hit by state COVID-19 restrictions. The majority of Oregon lottery sales come from video games in Oregon bars and restaurants. As indoor dining has been restricted or closed, lottery revenues have plummeted. However, long-term revenues are expected to rise to improving economic outlook and strong lottery sales in recent weeks. Economist recognize that risks to lottery sales include an over estimate on the pent-up demand for entertainment, competition for entertainment as the economy reopens and future health restrictions due to hot spots.

Although this forecast is a welcome sight, budget writers still face a challenging environment this session. They must balance the increased needs of the state. Recent estimates for Medicare and Medicaid caseload growth have been as high as $400 million. Human services caseload estimates are beginning to show the impact of pandemic-related job losses, and the state continues to face significant expenditure needs associated with the wildfires that occurred in September.

Long-term revenue growth is expected to remain modest during the 2021-23 budget period. Overall resources expected to be roughly flat over three budget cycles (excluding CAT). While much better than in most recessions, revenue gains are not fast enough to keep up with rising need and cost of public services.

We anticipate the Tri-Chairs of the Joint Committee on Ways & Means will wait until after a federal relief package reaches the President’s desk to issue their budget framework, a document we will likely see in early April.

The legislature will receive the next quarterly revenue forecast on May 19th. This will be the baseline that is used to finalize the 21-23 biennial budget.

Thank you to our colleagues at University of Oregon for contributing to this report.